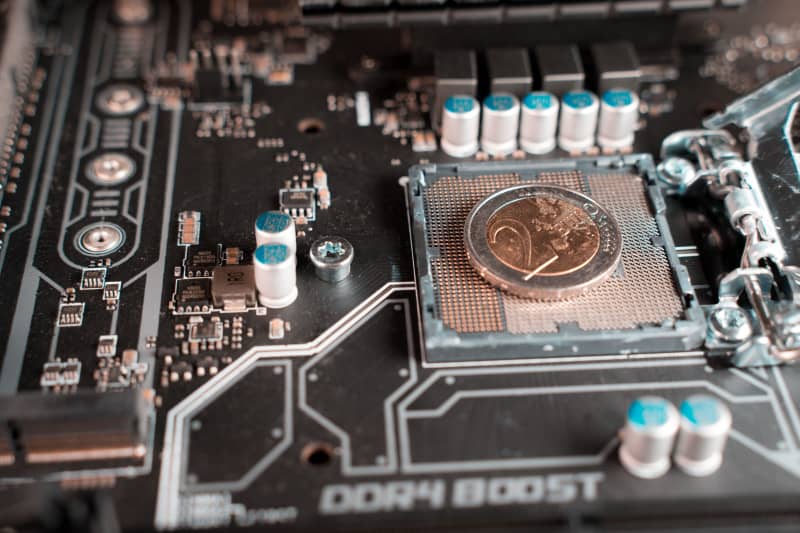

Now, payment traffic for Europeans is practically handled by two American companies. Central bank money could be used on a mobile phone, and it wouldn’t leave the same traces as with card payments.

When a tourist withdraws money abroad, he pays a small commission for his withdrawal.

Part of the reward, and also the information about the transfer of money, will probably go to one of the companies that dominate European bank and credit card payments, i.e. Visa or Mastercard in the United States.

However, in a few years, bank card payments may be a thing of the past and spending money will be free in the entire euro area.

The European Central Bank and other national central banks of the euro area are planning a new digital euro that would work on smartphones.

It would become a means of payment everywhere, and its use would not leave the same kind of payment trace as, for example, a bank card payment – so it would work like cash.

At the same time, the EU is planning a European wallet application for citizens.

What do digital euro and digital wallet mean? Read the concise answers below.

What changes?

Primarily, digital money will be used by people, companies and authorities living in the euro area. It is meant to be an alternative to cash.

In order to use Digieuro, you should use this information to download an application either through the European Central Bank or commercial banks such as Osuuspankki or Säästöpankki.

People living outside the euro area could also use digital money if they have an account in a bank in the euro area.

Using digital money would be free just like cash money: there would be no brokerage costs for payments like Visa and Mastercard purchases.

You could use digital euros directly from the central bank, and you wouldn’t necessarily need a bank account at a commercial bank in between. One of the open technical questions is how the central bank knows how to connect digieuro with the right consumer.

Why is the digital euro needed?

The use of cash is decreasing, and especially in Finland the transition from banknotes and coins to cards and applications has been clearly faster than in many other euro countries.

– Now there are two card companies whose debit and credit payments are used for almost all payments. When the second payment exchange, i.e. cash, decreases and becomes even more marginalized in the future, we need a new payment method in terms of operational security and resilience, Välimäki says.

According to the central bank, payment is a \”vital function\” where there must be competition and alternatives.

– That no one will have too strong a monopoly power to start pricing payments.

Would big brother start monitoring?

This is one of the issues that the digieuro drafters at the European Central Bank and the national central banks are currently trying to solve.

Whereas cash is anonymous, digital money will never be as unrecognizable.

– In today’s world, we cannot think that we could even build a completely anonymous means of payment. We must be able to prevent, for example, money laundering and the financing of terrorism, says Välimäki.

The anonymity of Digieuro is therefore somewhere between cash and bank cards.

China’s digital yuan, for example, offers authorities a way to monitor its citizens. Digieuro wants to prevent this.

– The idea is by no means that big brother would start supervising. The Eurosystem does not receive information about what individual people do with their money, it is taken care of, Välimäki emphasizes.

What is a digital wallet?

At the same time, EU member states and the Commission are preparing a so-called European wallet application. This digital wallet is all about digital identification.

– In Digieuro, reliable identification of a person is essential. If a digital personal data wallet exists, it can be used to identify the digieuro, says Välimäki.

In the new digital wallet, citizens could also carry with them, for example, a driver’s license, travel permit or insurance and diploma certificates. As in a regular purse, in a digital wallet they themselves would choose what to put there.

According to Kolinen, the wallet broadly benefits consumers.

– It’s an easy and new way to manage your own data. Especially if you’re doing something that crosses borders in the territory of other member states, even if you’re vacationing in the EU, it’s easy to show your driving license from the wallet on your phone when you, for example, rent a car on vacation, Kolinen describes.

When will digital tools be used?

The European Central Bank started the research and planning phase of digieuro just under two years ago. In the first phase, basic questions were clarified, such as how digital currency could technically work.

Only after that does the concrete implementation phase of digieuro begin.

The EU Commission will reportedly issue a draft law on the digital euro in May. After that, a blessing is still needed from the member states and the EU Parliament.

According to Välimäki, digital money could be in use in 4–5 years.

– Digital currency processes the type of payment and personal data that require the use of the most secure and protected data processing methods, says Välimäki.

– And in addition, it must be ensured that the new system does not get into the central bank’s balance sheet, so that it does not cause financial stability problems and does not jeopardize the implementation of monetary policy.

According to the current estimate, the digital wallet could be in use a little before the digital euro, in 2025 at the earliest. It is also difficult to resolve security issues.

– The whole being built is very technical, and developing a new kind of safe solution takes its own time, says Kolinen.

*What thoughts do the digital euro and the digital wallet evoke? You can discuss the topic until 11 pm on Friday evening.*