In a few years, the activities of financial counseling centers have expanded throughout the country. Financial counseling is now available for young people in more than thirty locations. Debt should be stopped in time.

The need for financial counseling for young people has also grown in Päijät-Hämee, where Talousneuvoloi started operating this fall. In the center of Lahti, in an old stone house, Juorten tukipalvelut Domino is located, which offers psychosocial support, discussion help.

The purpose of the low-threshold service is to get young people aged 17-25 to talk about their concerns, which they cannot or dare not talk about at home. There may be many kinds of problems, from study difficulties to substance abuse problems. Quite often there are also financial problems in the background.

Three hundred young people shop at Domino’s every year. Contact is often related to mood, depression or anxiety.

At the beginning of the year, the Talousneuvola activity, which has grown nationwide, is backed by a number of authorities and communities: for example, parishes, financial and debt counseling and the Bailout Office. The basic idea is to prevent young people’s financial problems.

Getting into debt is extremely easy

The number of young people in withdrawal has decreased slightly. In 2019, there were more than 48,000 customers under the age of 29, in 2021, a couple of thousand less. On the other hand, the number of young clients in the Päijät-Häme legal aid office’s financial and debt counseling has increased by a few percent.

There are many reasons for financial worries. In the foreclosure statistics, the most common debts of 15-18-year-olds include residual taxes, dental care fees and motor insurance. Financial and debt counseling and Domino’s in Lahti also see the issue more broadly.

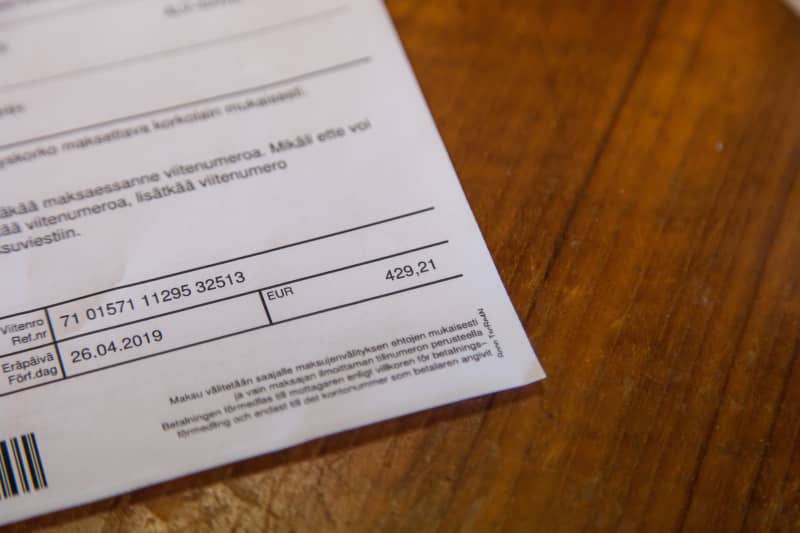

In the worst cases, a young person can have up to two hundred quick tips and dozens of game accounts for various online gambling sites, say those who work with young people. The costs caused by becoming independent bring a headache, for example the magnitude of housing costs can be a surprise to many. On a lighter end, small impulse purchases can mess up money matters.

Getting into debt is easier today than perhaps ever before, thinks Domino’s Taija Tamminen. With your mobile phone, you can get a quick tip in an instant, and quick payment gives birth to spontaneous spending.

– For example, at the gym it is easy to buy a drink with a mobile phone payment, which might cost three times as much as in the store, says Tamminen.

A young person is not necessarily irresponsible

Many things can lead to financial problems for a young person. Ignorance and incompetence are human causes. Those who work with young people’s financial problems say that, on a general level, the financial skills and responsibility of today’s young people are even better than the older generations.

– Some want to take care of their foreclosure matters actively, while some young people do not respond to payment reminders and are not contacted. The experience is that perhaps it is easier to leave small bills unpaid, and not even contact the bailiff, says Annika Tyynysniemi of Ulosottolaitot.

Since young people rarely have income eligible for seizure, they often have to be found to have no resources in these situations. Then, on top of that, they lose their credit information.

– It is gratifying that so many young people dare to seek help, stresses service director Taija Tamminen from the city of Lahti.